EU SUSTAINABLE FINANCE

DISCLOSURE REGULATION

EU SUSTAINABLE FINANCE

DISCLOSURE REGULATION

The Regulation (EU) 2019/2088 of the European Parliament and of the Council on sustainability‐related disclosures in the financial services sector (hereinafter referred to as the Regulation) was published on 9 December 2019 in the Official Journal of the European Union and is applicable since 10 March 2021.

The Regulation establishes harmonized rules on the transparency to be applied by financial market participants with regard to the integration of sustainability risks, the consideration of adverse sustainability impacts, and the promotion of environmental or social characteristics of investment products.

Global Social Impact Investments SGIIC SA (hereinafter, the Manager or GSI) is an impact investment manager and, as such, manages funds with direct, real, measurable and reportable social impact. GSI’s mission is not limited to the reduction of sustainability risks throughout its investment process. Each and every investment product managed will be based on (i) a problem that GSI wishes to contribute to solving and (ii) a theory of change that links the problem to its solution through the Fund’s investments.

ARTICLE 3 – Transparency of Sustainability Risk Policies

With regard to Article 3 of the Regulation, GSI not only integrates sustainability risks into its investments, but also undertakes an analysis of the positive impact that these investments are generating from the moment of their execution.

This analysis is carried out throughout the due diligence process for each investment.

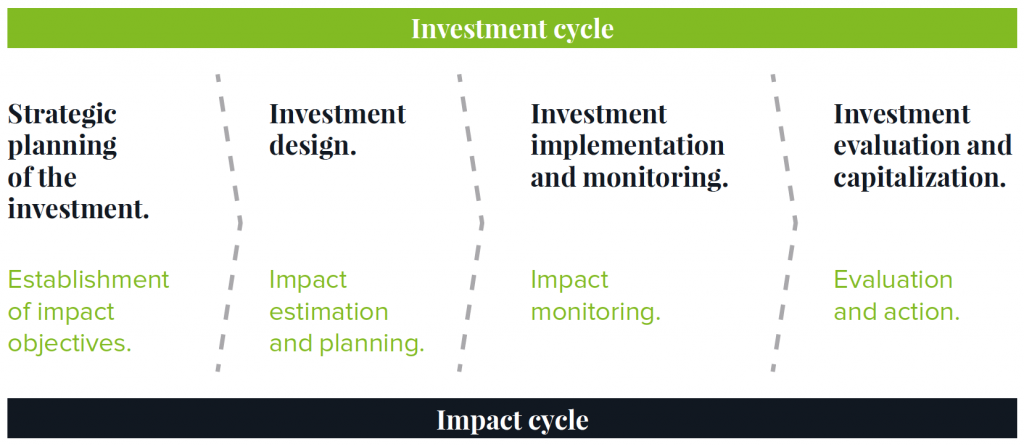

(i) Establishment of Impact Objectives

The starting point in the impact measurement and management cycle is the development of a theory of change for each fund, from which the investment thesis is defined. The impact strategy tells us what impact objectives we aim to achieve.

(ii) Impact Estimation and Planning

During the impact estimation phase, a portfolio analysis process is carried out to assess whether the companies or funds analyzed meet the established impact criteria, in addition to carrying out an evaluation according to the Impact Management Project (IMP).

The Due Diligence process is divided into three investment committees in which the following criteria are evaluated from an impact point of view:

- Social mission

- Stakeholders

- Theory of Change

- Contribution to the SDGs

- Governance

- DAC-OECD Methodology (Analysis of relevance, effectiveness, efficiency, impact, sustainability).

The final result of this process is the investment decision. If the decision is positive, a contract is drawn up which includes, among other aspects, the company’s Theory of Change and the scorecard of indicators on the basis of which the investee will report to GSI, which will include specific metrics agreed with the company or fund, generally linked to specific SDG metrics and standardized IRIS+ indicators.

(iii) Impact Monitoring

Once the company or fund is part of GSI’s portfolio, its impact is monitored periodically, based on the indicators set in the contract. These indicators help us to know to what extent the investments are meeting the objectives set.

GSI has an internal tool that allows us to carry out this monitoring. Its periodic nature and the close relationship with the investees allows us to identify possible areas for improvement and make suggestions, thus maximizing the impact.

(iv) Evaluation and Action

At the end of an investment cycle, there is the possibility of carrying out an additional analysis of the total aggregate impact, if deemed appropriate. This is an external evaluation of the real impact on the direct beneficiaries, which can be crucial when deciding, for example, whether to renew a loan or increase a position.

ARTICLES 4 and 7 – Transparency of adverse sustainability impacts at entity level and at financial product level

In relation to Articles 4 and 7 of the Regulation, GSI takes into account the Principal Adverse Impacts (PAIs) on sustainability factors in its investments. Thus, GSI would not be able to invest in a project that positively and directly contributes to one or more Sustainable Development Goals, and simultaneously impacts directly and negatively on others.

As a result of the development of the corresponding Theory of Change, each GSI product has a series of impact metrics and ESG indicators associated, on which the reporting to investors and stakeholders is based.

In general, the focus of GSI’s products will always be on the social component of the investments and based on the indicators most directly related to it. Notwithstanding this, each product will have cross-cutting indicators that will be taken into account for the evaluation of the investment in terms of impact. These indicators will consider the environmental and governance aspects (E and G) of the projects and will have both veto and measurement and monitoring elements.

This analysis of PAIs is always carried out according to the size, scale of operations and nature of the companies, so that the magnitude of the impact in terms of scale can be taken into account on a case-by-case basis.

ARTICLE 5 – Transparency of remuneration policies in relation to the integration of sustainability risks

With reference to Article 5 of the Regulation, GSI shall link the variable management fee of the management team, where available, to the achievement of impact targets set on an investment-by-investment basis. These objectives will be specifically designed for each investment and monitored throughout the investment in line with the processes detailed previously in this document, and will be audited by an expert at the date of divestment for the calculation of the variable management fee.

ARTICLE 10 – Transparency of the promotion of environmental or social characteristics and of sustainable investments on websites

With regard to Article 10 of the Regulation, GSI is an investment manager whose products target sustainable investments and fall within the scope of Article 9 of the Regulation.

In particular, the focus of GSI’s products will always be the economic and social inclusion of the most vulnerable groups in the regions where the investments are made, as defined in the theory of change of each product.

GSI will always invest in business models that directly, intentionally and measurably contribute to alleviating the problems that each fund seeks to help solve.

No benchmark has been designated to date in relation to the impact of GSI’s products, pending the development of a benchmark that can adequately measure the social criteria governing GSI’s theory of change.

GSI’s website contains additional information regarding GSI’s investment and impact criteria.

STATEMENT ON THE MAIN ADVERSE IMPACTS OF INVESTMENT DECISIONS ON SUSTAINABILITY CRITERIA

(Corresponds to Annex I of Commission Delegated Regulation 2022/1288 of 6 April 2022 in relation to Prospectus Annexes for SFDR Article 8 or 9 funds)

Global Social Impact Investments SGIIC SAU is an impact investment funds manager that allows investors to achieve positive social and environmental impact together with financial returns.

GSI is part of Santa Comba Gestión SL, a family holding that brings together projects promoting freedom through knowledge.

-

Paseo de la Castellana, 53, 2nd floor

28046 Madrid (Spain)

Write your email address below and we will keep you informed of our news

© Copyright 2023. Global Social Impact Investments SGIIC SAU